What’s Love Got To Do With It

Exploring the different ways we experience love, why we like it like that, how it impacts our relationship with money & how that impacts our relationships

But First, the news

Finance Therapy Circle - but make it Neurospicy! We’ll be joined by the AudDHD goddess that is Sam Sunduis, making space for all things neurodivergent money. All brains welcome! 17th Feb, 5.30pm GMT

Co-hosting a very fun "!IN PERSON! Zine workshop with the CutOutClub. Let’s get crafty and talk money on 23rd Feb. Grab one of the final few tickets available - This one is popular!

I’m speaking at Mind To Mood in Manchester on 28th Feb. Join us for all your burnout recovery, resilience building for success and wholesome healing needs.

Can't Help Falling In Love

Valentine’s Day is here, and whether you love it, hate it, or pretend it doesn’t exist, it’s hard to ignore the billion-dollar industry built around it. Everywhere you look, there’s pressure; to spend, to gift, to celebrate and prove love through your money. But beneath the roses and heart-shaped chocolates lies a deeper truth: the way we give, receive, and even think about money is often tied to our emotional wiring, our past, and how we experience love itself.

We talk about love languages - the ways we express and receive love - but have you ever thought about your financial love language? How does your relationship with money reflect your need for security, connection, or validation? And more importantly, how is it shaping your financial well-being, and your relationships?

It’s a Love Story

Do you remember your first experience of love? No, I’m not talking about celebrity crushes, high school romances or that obsessively watching A Cinderella Story phase we all went through (we all went through that, right?)

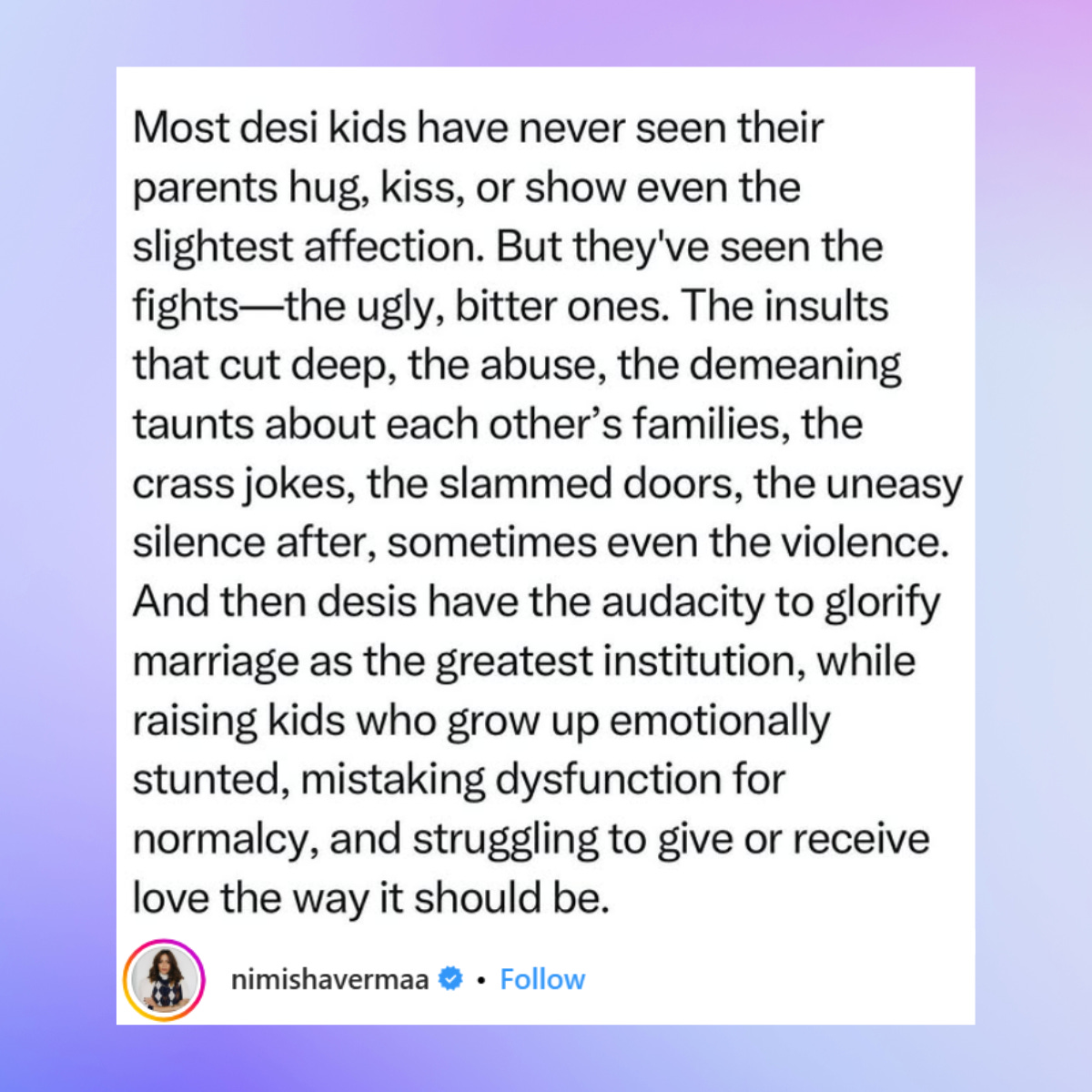

I mean how did you see and feel love at home? Were your parents or carers in love? Did they show it? Or were they simply tolerant of each other - getting through the mundane tasks of day-to-day life and surviving - because it’s the only way they knew how? Maybe you were a child of divorce, and your first experience of love told you the story that love was messy, fragile and it could never be forever.

The way you saw and experienced love as a child will impact the way you express and receive love today. And most of us usually fall into a couple of these categories: words of affirmation, quality time, receiving gifts, physical touch, and acts of service.

As a South Asian woman, I grew up and still live by a deep fear of PDA. I never saw real affection, and I dare not show it - at least not in front of my community - so, that’s physical touch out of the window. I also rarely heard the words “I love you”, it’s still awkward as f*ck to say it to my parents, and feels even harder for them to say it back. These days I’ll make a point to force it back out of my mum on the phone. And my siblings? Forget about it! So I guess that’s words of affirmation out from me too - sorry lovers and friends.

Instead we were shown love through bowls of cut up fruit whilst we studied, forever clean clothes and tidy rooms, thoughtful birthday presents (obviously that was all mum), a fully stocked fridge, after dark pick-ups, constantly being asked if we’ve eaten/what we want to eat, and - my all time favourite - being fed whilst being called fat. Yes, you guessed it, I’m an acts of service kind of girl & I love to give gifts - but I really don’t care too much for receiving them.

My parents were young, worked full time, and my grandparents retired to look after us - which meant I didn’t get all the time in the world with them. They also decided to give me an extra two siblings as I hit my teens - so as the oldest child of four, quality is not the word I would use to describe the time I got. So, yes, the quickest way to my heart is your undivided attention - often! Preferably in a warm place with mountains and beautiful beaches ;)

Now that you know the very important details of how I like to give and receive love, ask yourself:

‘When's the last time you reflected on how your family has impacted the way you give and receive love?’ The more you understand yourself and why you value the things you do - the easier it is to find and fulfil those needs without blame, guilt, shame and embarrassment.

Can’t Buy Me Love

Money carries emotional weight - fear, joy, shame, security, guilt, control. And love? Love is the same. It’s tied to safety, belonging, self-worth. Of course the two are so tangled together.

Just because you give and receive love in certain ways, it doesn’t mean your ‘financial love language’ has to directly correlate. As we get older, understand our trauma and heal childhood wounds, our relationships to love and money evolve too. We’re also much more susceptible to the narratives of strangers on the internet than ever before, shaping the way we think about dating, gender roles and the way we earn and spend money in our partnerships.

The only thing that really matters is how you feel about a given situation. Tuning into what you truly feel and want can help you understand how your love language and relationship to money play into the financial aspects of your relationships.

Maybe you’ve felt this before:

You overspent on a gift because it felt like a way to prove your love.

You’ve felt unappreciated when a partner didn’t acknowledge the effort you put into a trip, a birthday, event or even the general running of the household.

You’ve taken on financial burdens in a relationship, not because you wanted to, but because it felt like your role.

You’ve avoided money conversations with loved ones because talking about it felt uncomfortable or unsafe.

Understanding your financial love language can help you see where your behaviours come from and give you the tools to create a healthier relationship with both love and money.

I Like It Like That

Hopefully you’ve reflected on your love language and know how you feel you can safely give and receive love in your relationships. But how do you show up, and want to be looked after when it comes to one of the most important aspects of our relationships - money.

Our finances require a huge amount of trust and humility - and we can barely do that for ourselves. So when it comes to sharing the load, it becomes even more important to understand and express our values in order to build healthy and lasting relationships. Finances are one of the top reasons for divorce after all - and no one goes into marriage hoping to be another statistic.

Just as you don’t need to be in a relationship to show yourself some love, you should absolutely understand your financial love language to better care for yourself financially, too.

1. Words of Affirmation → Financial Validation

You feel loved and secure when you are recognised and appreciated. So talking openly and honestly about your finances can help you feel more connected and empowered. Maybe you grew up in a household where money was a source of stress, or even control, and now, hearing someone say, “You’re really good at managing money” or “I appreciate how thoughtful you are with our finances” makes you feel safe and valued.

But what happens when you don’t get that validation? Does it trigger self-doubt or guilt? Remember, not everyone is comfortable talking about money, so practicing giving those words of affirmation with positivity and encouragement can go a long way in opening up important money conversations and getting the validation you need in return in your relationships.

Tip: If this resonates, practice internal validation. Acknowledge your own financial progress instead of waiting for external praise. Journaling small money wins can help shift your mindset.

2. Acts of Service → Financial Caretaking

You express love by doing - from unpaid household labour, to covering bills, managing finances for your family, or stepping in to help a loved one in financial distress. Maybe this comes from a deep-rooted need to be needed, or perhaps you saw money as a form of care growing up.

The danger? You might take on too much responsibility, neglecting your own needs in the process. Many of us have watched our mothers give their lives and ambitions to this love language, and perhaps we’re doomed to repeat the cycle. We have the power to reframe caretaking and drop the guilt when we’re unable or unwilling to perpetuate the cycle of self-sacrifice. Performing acts of service is a beautiful thing, as long as we remember that we’re worthy of being taken care of too.

Tip: Check in with yourself - are you giving from a place of love or obligation? Set financial boundaries. It’s okay to help, but not at the expense of your own well-being.

3. Receiving Gifts → Money as Love

For you, gifts aren’t just things - they’re symbols of care, effort, and thoughtfulness. You feel valued when someone buys you a meaningful gift, and you express love the same way. But sometimes, this can turn into emotional spending - buying things to feel worthy, loved, or to avoid discomfort.

It’s also important to remember that we don’t all value the same things, especially when there’s a price tag involved. As much as we love for gifts to be a surprise, we’re not 7 years old and don’t still believe in Santa Clause. It’s ok to discuss gifting with your loved ones and it doesn’t have to take away the magic and romance from the experience. Get on the same page about when you’ll gift and how much you’ll spend. It will help you avoid the hurt feelings in the long run.

Tip: Ask yourself: Is this gift an extension of love, or am I seeking validation? Shift towards non-monetary expressions of affection - handwritten notes, shared experiences, or meaningful conversations.

4. Quality Time → Money as Presence

You prioritise shared experiences over material things. Money, to you, is a tool for connection - trips, dinners, deep conversations over coffee. But does this ever lead you to overspend on social events or struggle to say no when friends invite you somewhere you can’t afford?

Yes, my fellow quality timers , FOMO can be real for us and detrimental to our wallets. Once again, having those difficult conversations upfront can erase the pain of those heart palpitations when we’ve over committed for the 6th time this month. We might also commit our time to things that don’t serve our overall long term goals - like giving up work opportunities to join the girls trip, or rescheduling valuable networking to spend more time with your loved one. Let people know how much quality time you want and how you want to spend it, so that you can both get what you need, when you need it.

Tip: Learn to separate quality time from cost. True connection doesn’t have to come with a price tag. Find ways to nurture relationships without financial pressure - walks, home-cooked meals, game nights.

5. Physical Touch → Money as Security

You might not associate love with money at all, but security matters deeply to you. You feel safe when finances are stable - when there’s a savings cushion, a plan, a sense of control. Financial instability can feel like emotional instability, leaving you anxious or withdrawn.

Maybe you’re not great at handling your finances and building a financial future with someone feels like the most romantic thing in the world - it says, I don’t know where we’re going, but I know we’re going together - you’ve got me and I’ve got you and we won’t be sweating the small stuff along the way.

Tip: Build financial rituals that reinforce security. Monthly money check-ins, automation for savings and investments, joint financial planning and small actions that create consistency and emotional calm.

For The Love Of Money

Recognising your financial love language is the first step. The next? Using that awareness to build healthier money habits. Here’s how:

Reflect: Think about your past experiences with money and love. What patterns do you notice? What fears or beliefs do you hold?

Communicate: Talk to your partner, family, or friends about your financial needs and boundaries. Healthy money conversations strengthen relationships. Go and practice with your least judgemental friend first (or the one that’s never listening - just to get the words out)

Rewrite the Narrative: If you’ve linked money to self-worth, obligation, or fear, challenge those beliefs. Money is a tool, not a measure of love or value.

Practice Self-Compassion: Your financial behaviours were shaped by your experiences, but they don’t have to define your future. Small changes lead to transformation.

Love Is In The Air

At its core, love - whether romantic, familial, or self-love - is about feeling seen, valued, and safe. So is financial well-being. The more we understand our emotional relationship with money, the more we can create a life that aligns with what truly matters to us.

So, what’s your financial love language? And more importantly, how can you make sure your money habits are serving, not sabotaging, your well-being?

Drop a comment—I’d love to hear your thoughts. 💕